How to do Futures Trading on BYDFi

What are Perpetual Futures Contracts?

Regular futures contracts lock you into buying or selling an asset at a specific price by a certain date. Perpetual contracts, however, are for speculators who want to bet on future prices without owning the asset or worrying about expiry. These contracts go on forever, letting you ride out market trends and potentially score big profits. They also have built-in mechanisms to keep their price aligned with the actual asset.

With perpetual contracts, you can hold your position for as long as you want, provided you have enough funds to keep it going. There’s no set time to close your trade, so you can lock in profits or cut losses whenever you see fit. It’s important to note that perpetual futures aren’t available in the US, but they’re a massive market globally, making up about three-quarters of all crypto trading last year.

While perpetual futures offer a way to jump into the crypto market, they’re also risky and should be approached carefully.

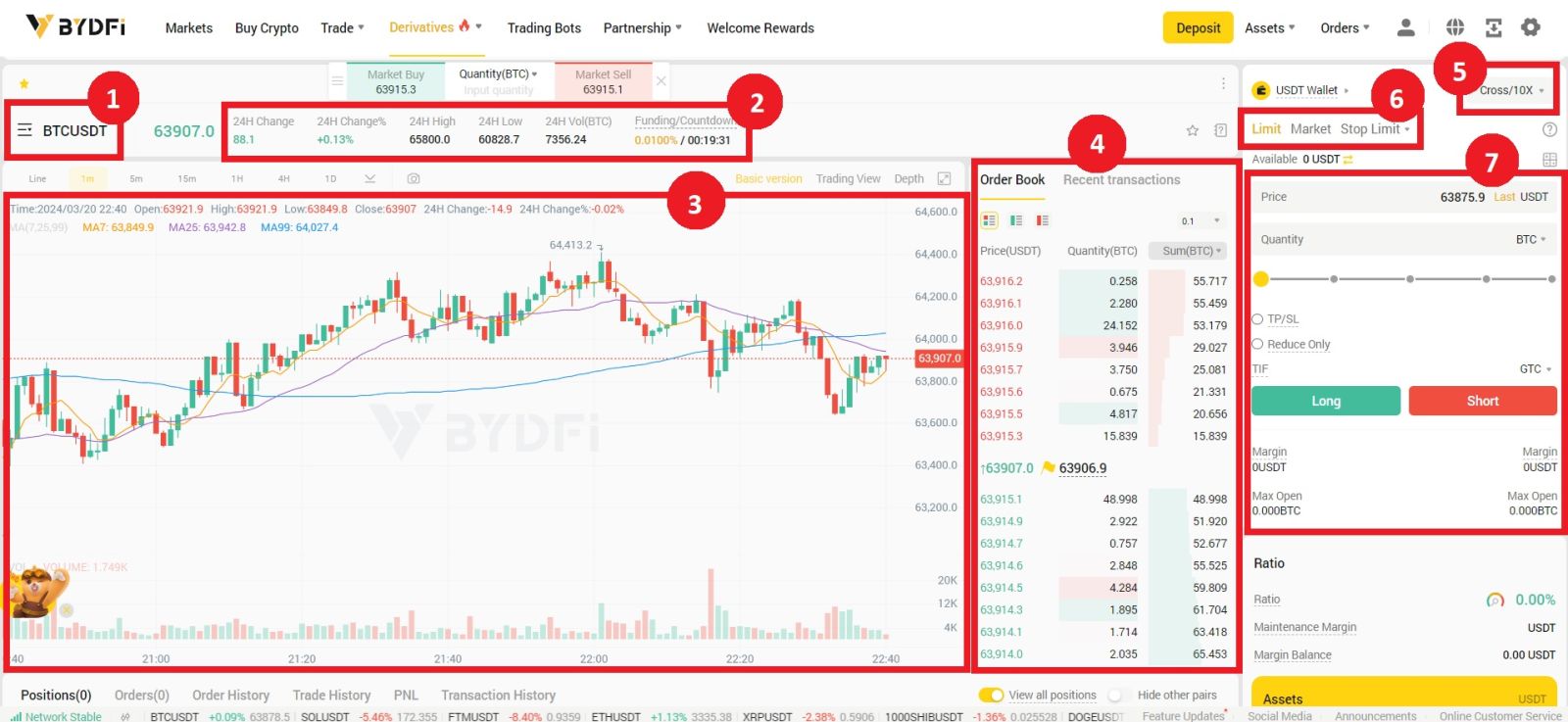

1. Trading Pairs: Shows the current contract underlying cryptos. Users can click here to switch to other varieties.

2. Trading Data and Funding Rate: Current price, highest price, lowest price, increase/decrease rate, and trading volume information within 24 hours. Display the current and next funding rate.

3. Trading View Price Trend: K-line chart of the price change of the current trading pair. On the left side, users can click to select drawing tools and indicators for technical analysis.

4. Orderbook and Transaction Data: Display current order book order book and real-time transaction order information.

5. Position and Leverage: Switching of position mode and leverage multiplier.

6. Order type: Users can choose from a limit order, market order and stop limit.

7. Operation panel: Allow users to make fund transfers and place orders.

How to Trade USDT-M Perpetual Futures on BYDFi (Web)

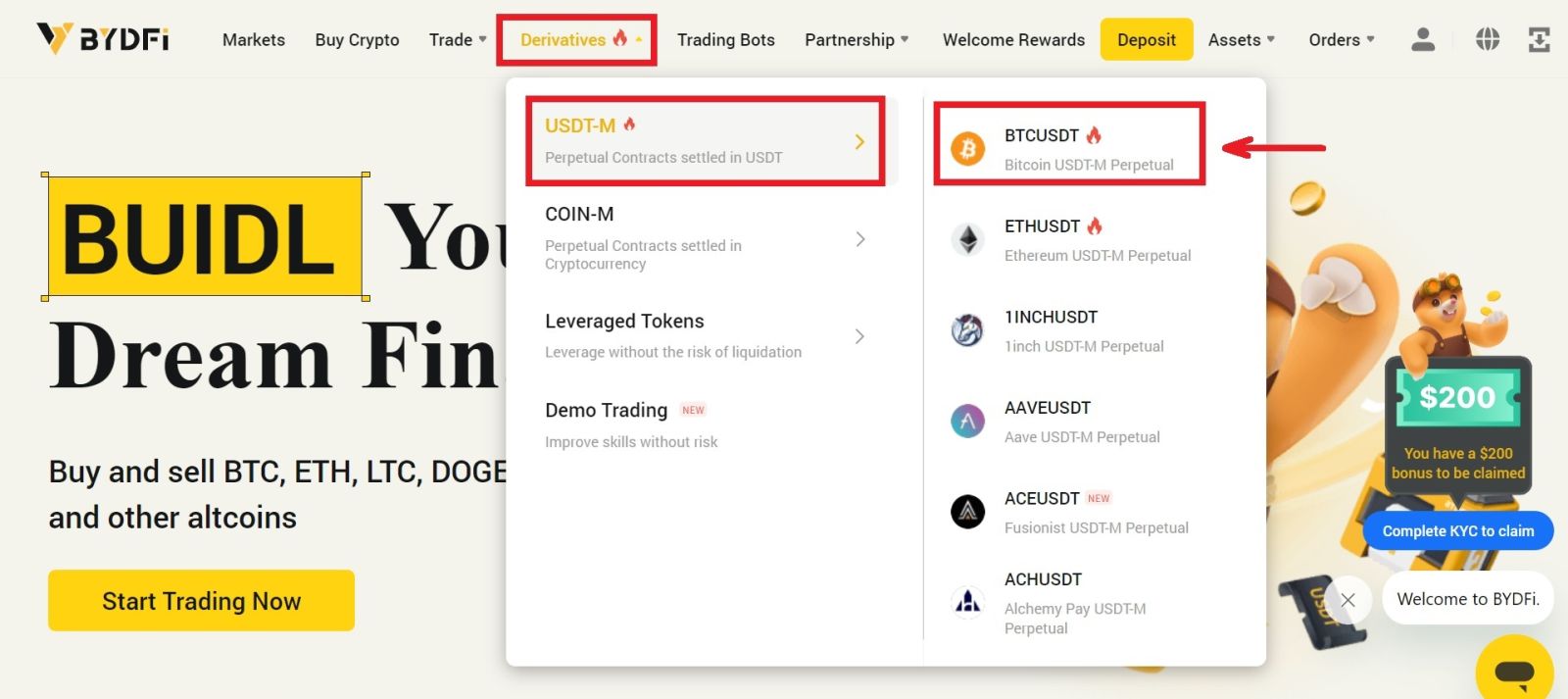

1. Navigate to [Derivatives] - [USDT-M]. For this tutorial, we’ll select [BTCUSDT]. In this perpetual futures contract, USDT is the settlement currency, and BTC is the price unit of the futures contract.

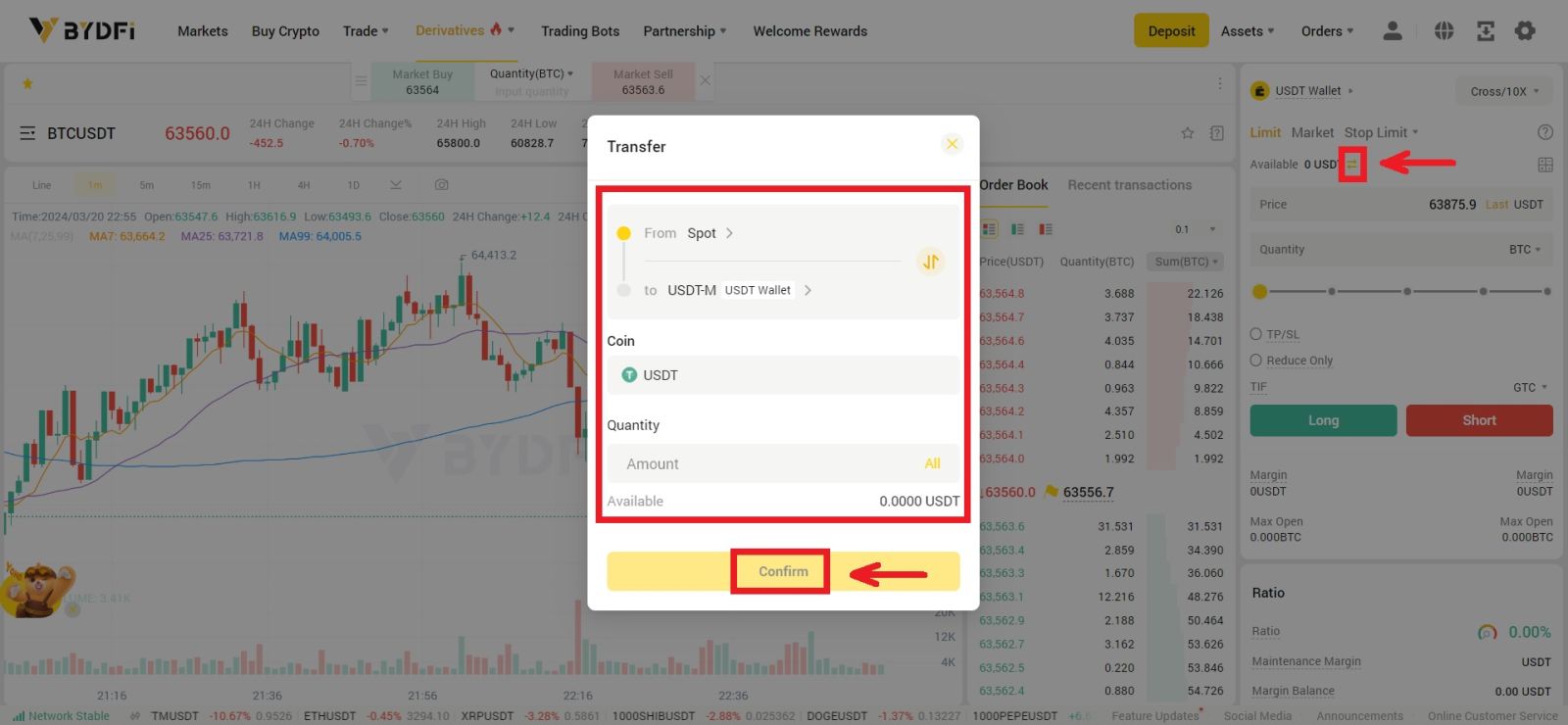

2. To trade on BYDFi, your funding account needs to be funded. Click on the arrow icon. Then transfer funds from Spot to Futures account. Once you’ve selected a coin or token and entered your desired amount to transfer, click [Confirm].

3. You can select the margin mode at [Cross/10X] and choose between “Cross” and “Isolated”.

- Cross margin utilizes all the funds in your futures account as the margin, including any unrealized profits from other open positions.

- Isolated on the other hand will only use an initial amount specified by you as the margin.

Adjust the leverage multiplier by clicking on the number. Different products support varying leverage multiples—please check the specific product details for more information. Then click [Confirm].

4. To open a position, users can choose between three options: Limit Order, Market Order, and Stop Limit.

- Limit Order: Users set the buying or selling price by themselves. The order will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for the transaction in the order book;

- Market Order: Market order refers to the transaction without setting the buying price or selling price. The system will complete the transaction according to the latest market price when placing the order, and the user only needs to enter the amount of the order to be placed.

- Stop Limit: A stop limit order combines the functionality of a Stop Loss trigger with a Limit Order, which allows you to set a minimum profit you wish to accept or a maximum loss you are willing to take on a trade. Once a Stop Loss order is set and the trigger price is reached, the limit order is automatically posted even if the order is exited.

You can also select either Take profit or Stop loss by ticking [TP/SL]. When using these options, you can enter conditions for taking profit and stopping loss.

Choose the desired “Price” and “Quantity” for the trade. After entering order details, you can click on [Long] to enter a long contract (i.e., to buy BTC) or click on [Short] if you would like to open a short position (i.e., to sell BTC).

- Buying long means that you believe the value of the asset that you are buying is going to rise over time, and you will profit from this rise with your leverage acting as a multiple on this profit. Conversely, you will lose money if the asset falls in value, again multiplied by the leverage.

- Selling short is the opposite, you believe that the value of this asset will fall over time. You will profit when the value falls, and lose money when the value increases.

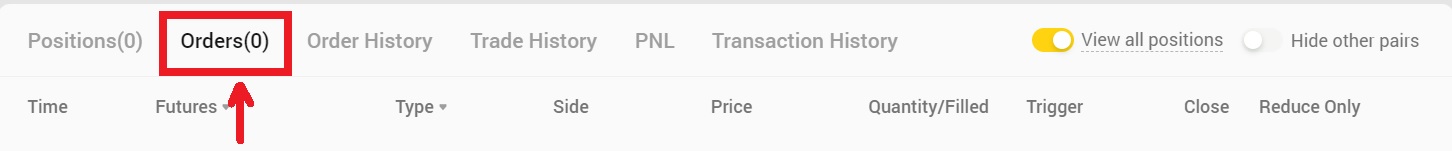

5. After placing your order, view it under [Orders] at the bottom of the page.

How to Trade USDT-M Perpetual Futures on BYDFi (App)

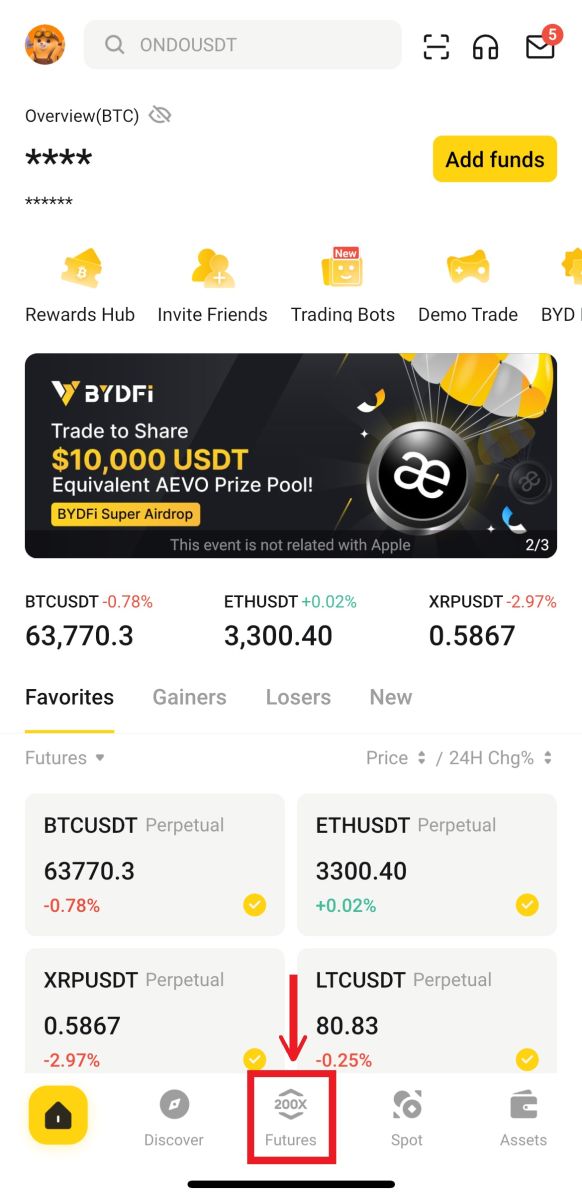

1. Log in to your BYDFi account and click [Futures].

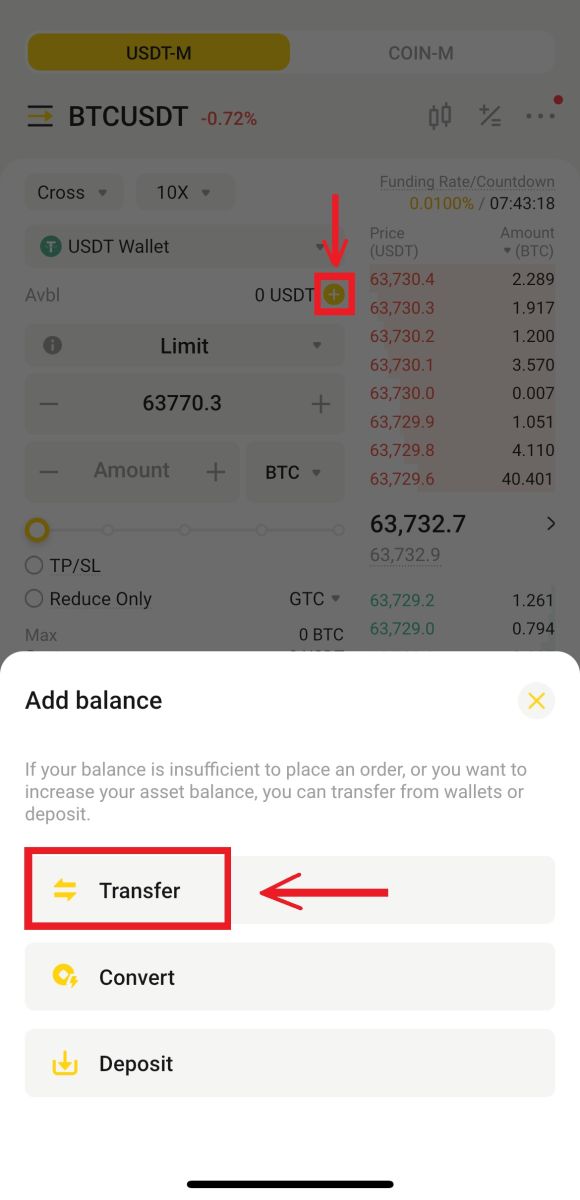

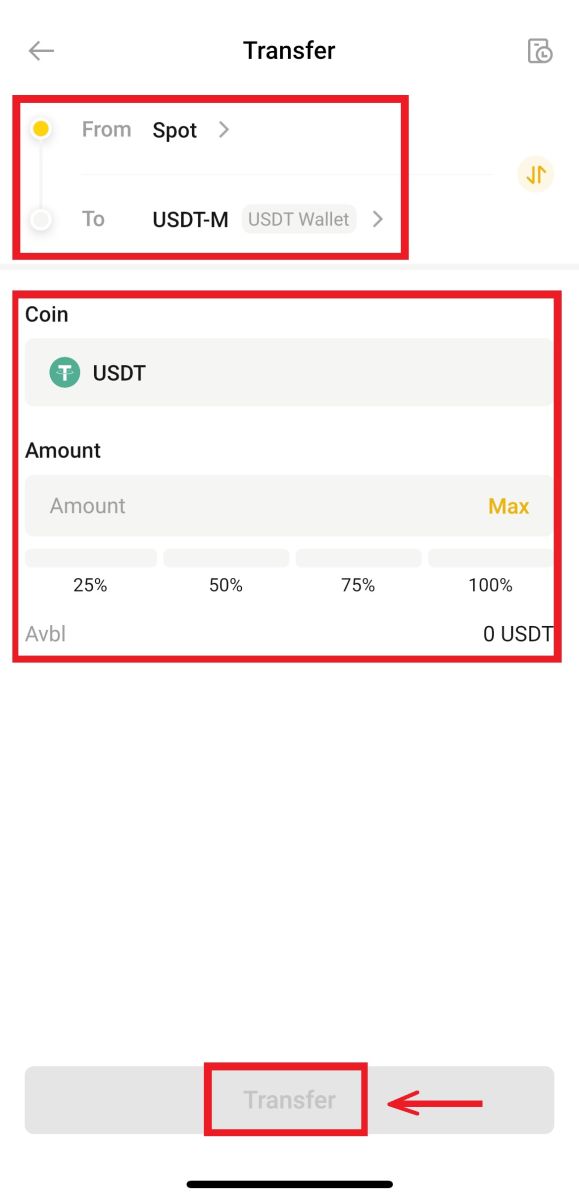

2. To trade on BYDFi, your funding account needs to be funded. Click on the plus icon, click [Transfer]. Then transfer funds from Spot to Futures account. Once you’ve selected a coin or token and entered your desired amount to transfer, click [Transfer].

3. For this tutorial, we’ll select the [USDT-M] - [BTCUSDT]. In this perpetual futures contract, USDT is the settlement currency, and BTC is the price unit of the futures contract.

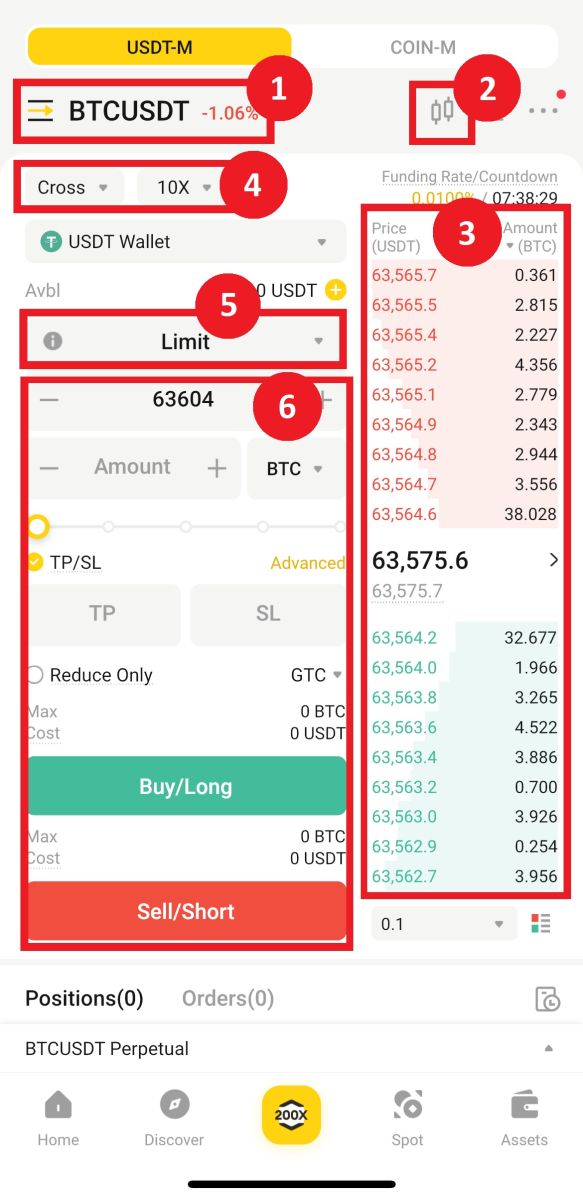

1. Trading Pairs: Shows the current contract underlying cryptos. Users can click here to switch to other varieties.

2. TradingView Price Trend: K-line chart of the price change of the current trading pair. On the left side, users can click to select drawing tools and indicators for technical analysis.

3. Orderbook and Transaction Data: Display current order book order book and real-time transaction order information.

4. Position and Leverage: Switching of position mode and leverage multiplier.

5. Order type: Users can choose from a limit order, market order and trigger order.

6. Operation panel: Allow users to make fund transfers and place orders.

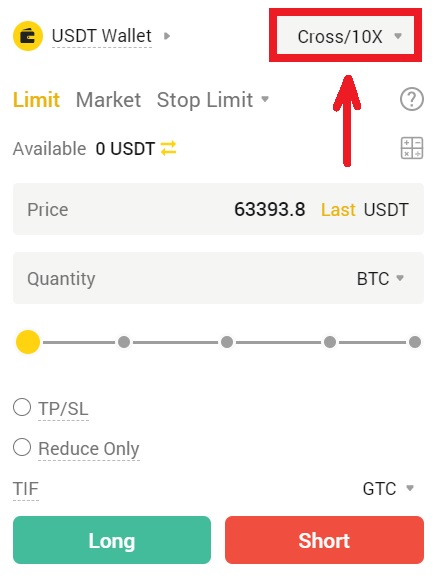

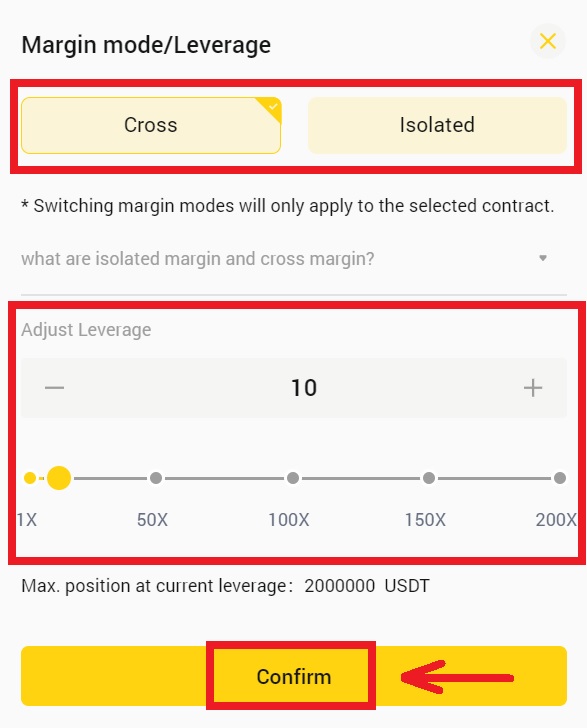

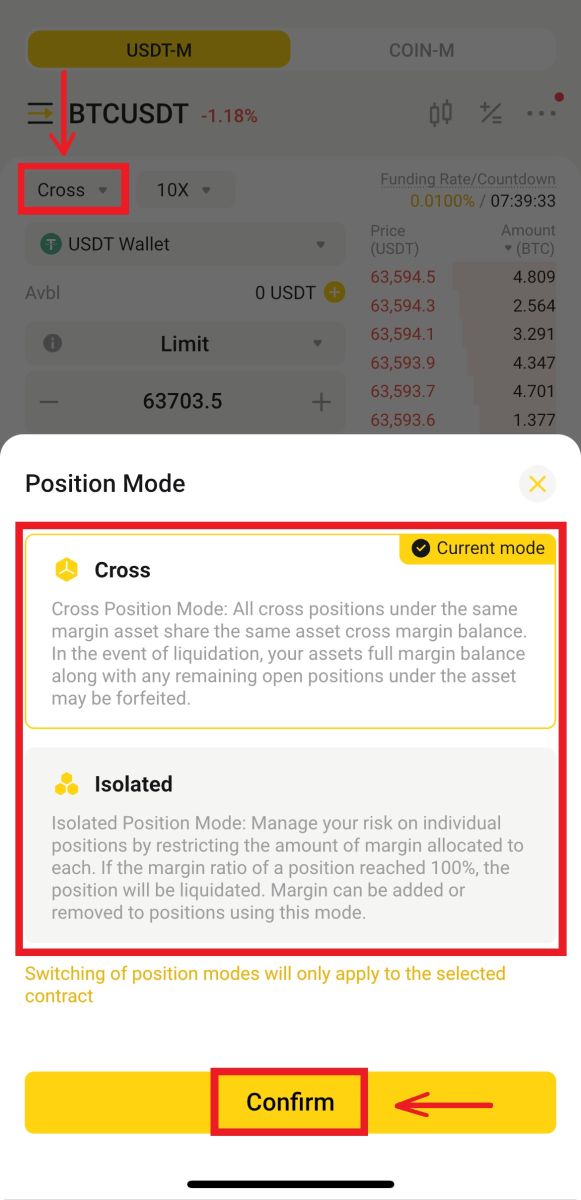

4. You can select the margin mode - Cross and Isolated.

- Cross margin utilizes all the funds in your futures account as the margin, including any unrealized profits from other open positions.

- Isolated on the other hand will only use an initial amount specified by you as the margin.

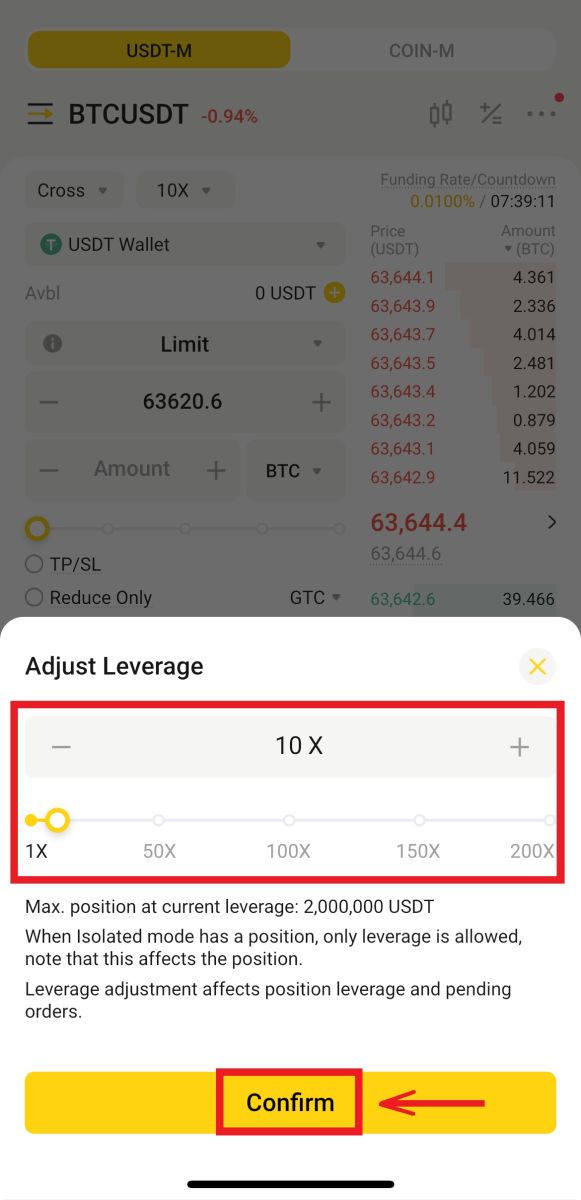

Adjust the leverage multiplier by clicking on the number. Different products support varying leverage multiples—please check the specific product details for more information.

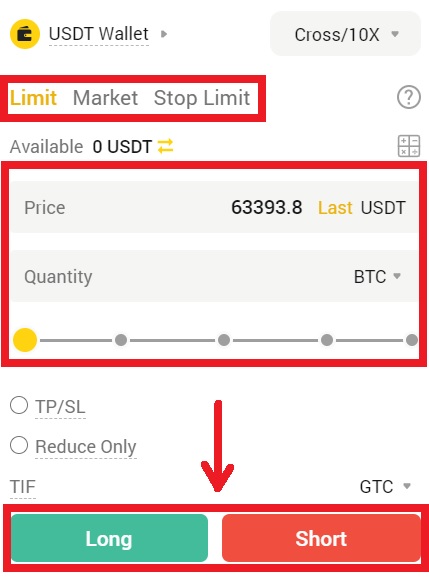

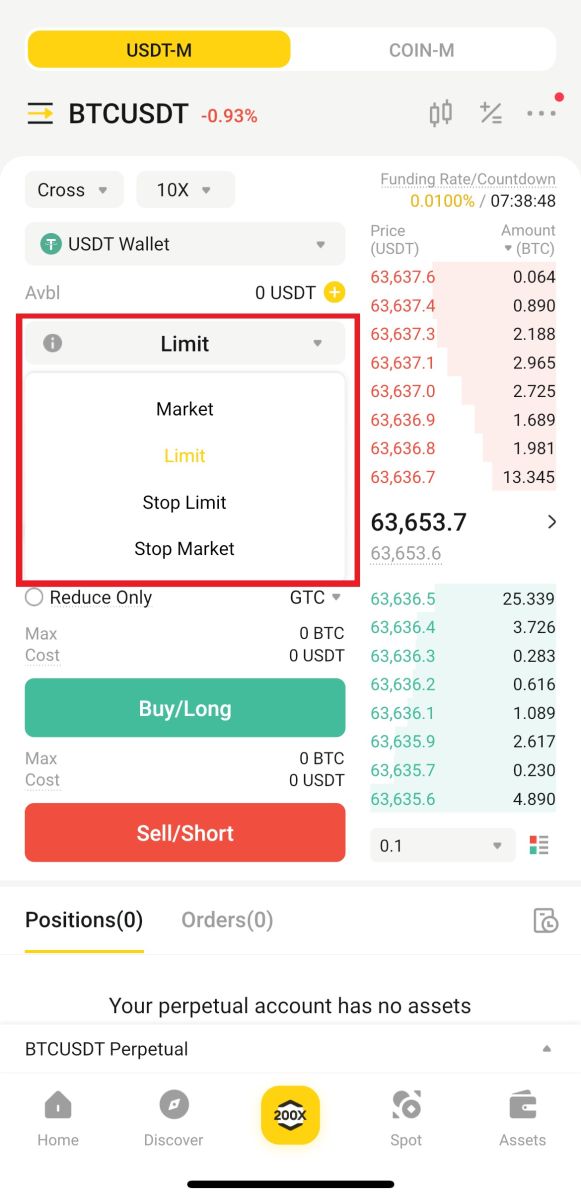

5. To open a position, users can choose between three options: Limit Order, Market Order, Stop Limit, and Stop Market.

- Limit Order: Users set the buying or selling price by themselves. The order will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for the transaction in the order book;

- Market Order: Market order refers to the transaction without setting the buying price or selling price. The system will complete the transaction according to the latest market price when placing the order, and the user only needs to enter the amount of the order to be placed.

- Stop Limit: A stop limit order combines the functionality of a Stop Loss trigger with a Limit Order, which allows you to set a minimum profit you wish to accept or a maximum loss you are willing to take on a trade. Once a Stop Loss order is set and the trigger price is reached, the limit order is automatically posted even if the order is exited.

- Stop Market: When a stop market order is triggered, it will become a Market Order and will be filled immediately.

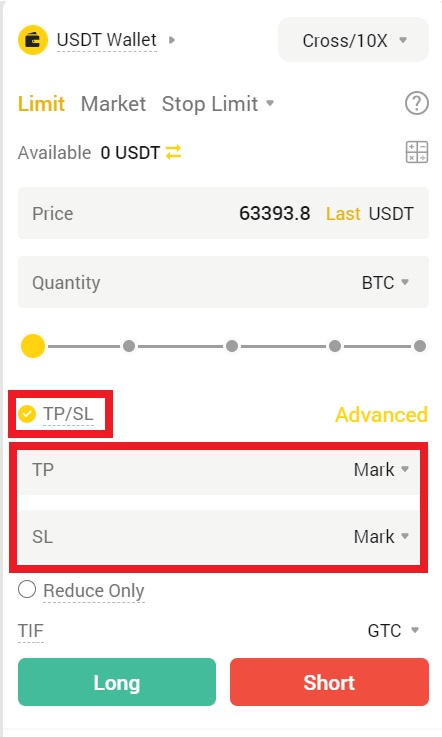

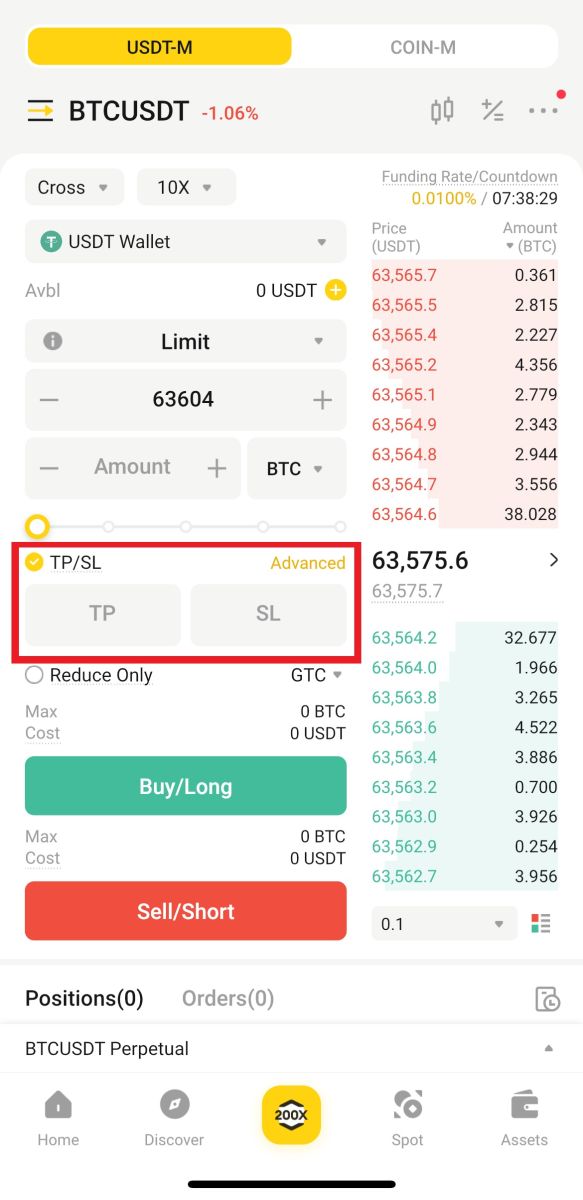

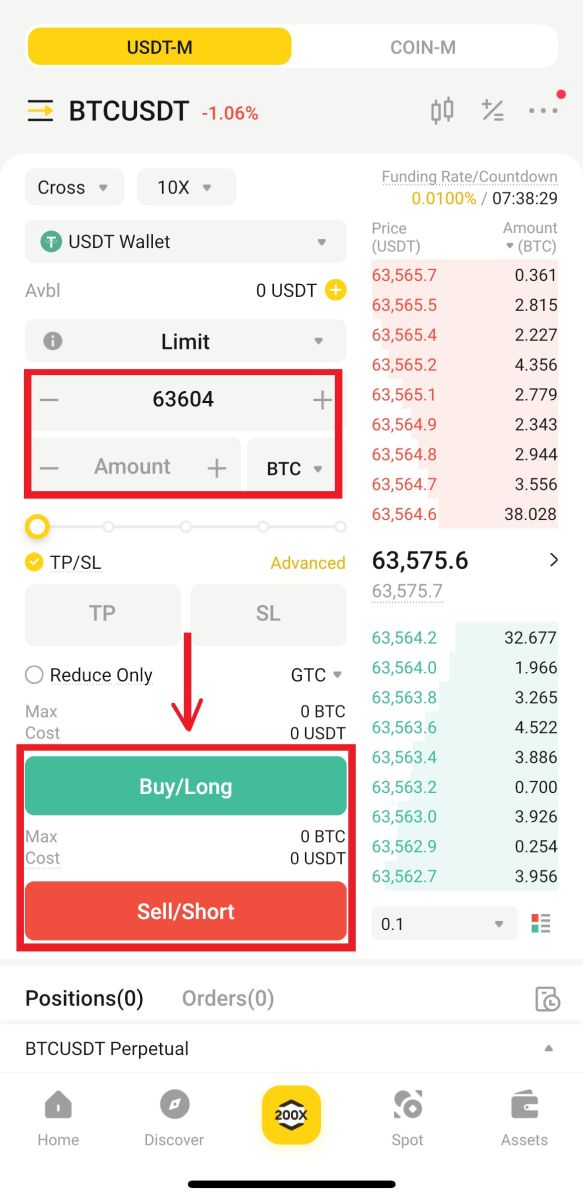

6. Before you click [Buy/Long] or [Sell/Short], you can also select either Take profit [TP] or Stop loss [SL]. When using these options, you can enter conditions for taking profit and stopping loss.

7. Choose the desired “Order Type,” “Price” and “Amount” for the trade. After entering order details, you can click on [Buy/Long] to enter a long contract (i.e., to buy BTC) or click on [Sell/Short] if you would like to open a short position (i.e., to sell BTC).

- Buying long means that you believe the value of the asset that you are buying is going to rise over time, and you will profit from this rise with your leverage acting as a multiple on this profit. Conversely, you will lose money if the asset falls in value, again multiplied by the leverage.

- Selling short is the opposite, you believe that the value of this asset will fall over time. You will profit when the value falls, and lose money when the value increases.

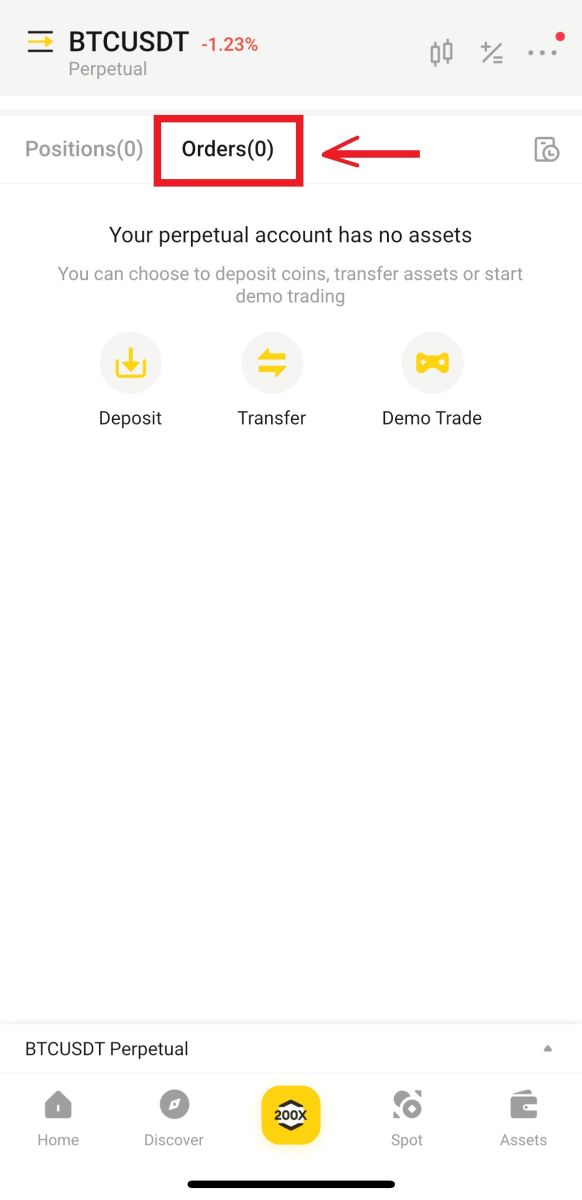

8. After placing your order, view it under [Orders(0)].

Frequently Asked Questions (FAQs)

What is the USDT-M Perpetual Contract? How is it different from a COIN-M Perpetual Contract?

The USDT-M Perpetual Contract, also known as the forward contract, is commonly known as the USDT-margined contract. The USDT-M Perpetual Contract margin is USDT;

The COIN-M Perpetual Contract means that if a trader wants to trade the BTC/ETH/XRP/EOS contract, the corresponding currency must be used as the margin.

Can the cross-margin mode and isolated margin mode of the USDT-M perpetual contract be switched in real time?

BYDFi supports switching between the isolated/cross modes when there are no holding positions. When there is an open position or a limit order, switching between the isolated/cross modes is not supported.

What is the risk limit?

BYDFi implements a tiered margin system, with different levels based on the value of user positions. The larger the position, the lower the leverage allowed, and the initial margin rate is higher when opening a position. The larger the value of the contract held by the trader, the lower the maximum leverage that can be used. Each contract has a specific maintenance margin rate, and margin requirements increase or decrease as risk limits change.

Can the unrealized profit be used to open positions or make withdrawals?

No, in the cross-margin mode, the unrealized profit can only be settled after the position is closed.

Unrealized profit does not increase the available balance; therefore, it cannot be used to open positions or withdraw funds.

In the cross-margin mode, the unrealized profit cannot be used to support trading pairs in different positions.

For example: BTCUSDT’s unrealized profits cannot be used to support ETHUSDT’s position losses.

Is the insurance pool for USDT-M Perpetual Contracts shared or currency-independent?

Unlike COIN-M Perpetual Contracts that use the currency standard for settlement, USDT-M Perpetual Contracts are all settled in USDT. The insurance pool of USDT-M Perpetual Contracts is also shared by all contracts.